Over the past few months, Tanya Monestier, a University at Buffalo law professor who also describes herself as a consumer advocate, has written some scathing commentaries and critiques of industry practices—specifically focused on new buyer agreements that have been crafted or updated to satisfy the National Association of REALTORS®’ (NAR) settlement mandate.

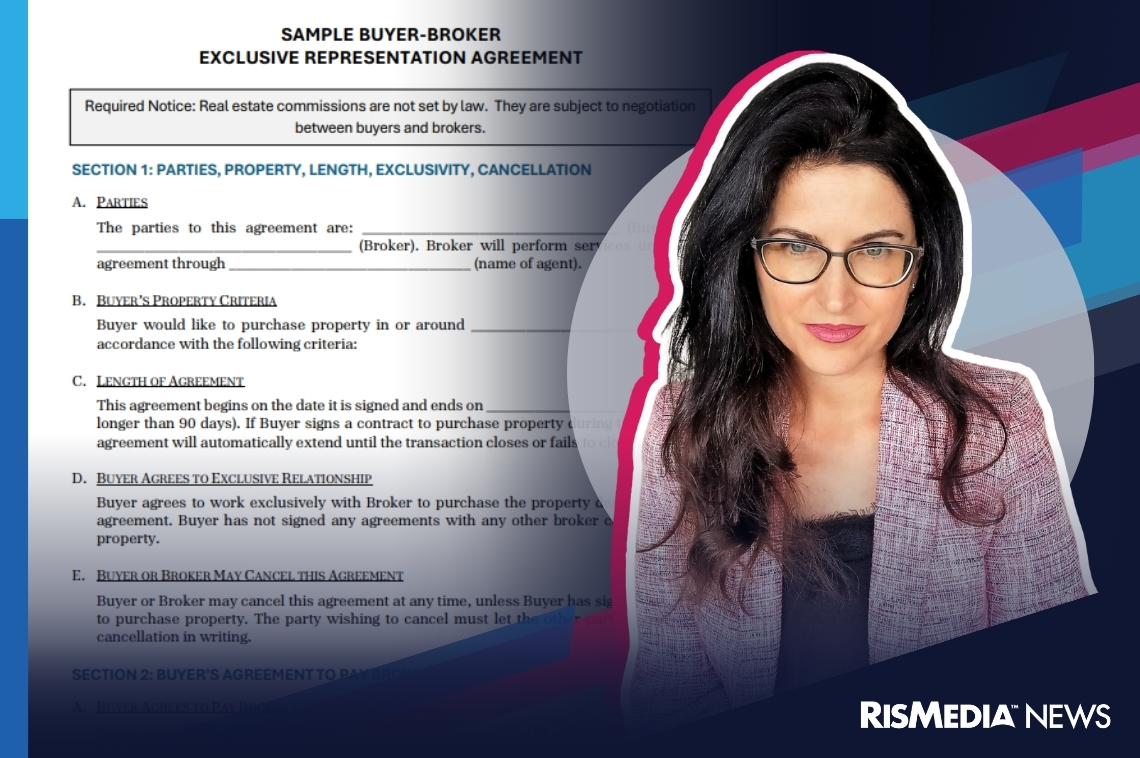

Unlike many critics, though, Monestier decided to put her money where her mouth is, and recently penned her own “sample” contract, despite having no experience in real estate transactions. Against the backdrop of looming government intervention, and with disparate regional practices governing buyer agent agreements, Monestier tells RISMedia her goal is simply to push the industry to create more consumer-friendly contracts.

“I wouldn’t say I’m hoping it will be put to use,” she says. “I’m hoping to start a conversation about how to craft more fair and balanced contracts that buyers can understand. This is intended to be an illustration of that.”

At three pages long and just over 1,000 words, Monestier’s agreement is neither the longest nor the shortest currently circulating through the industry. But she says it does something that “very few” contracts she personally reviewed could claim to do.

“In drafting a sample or model buyer representation contract I have attempted, foremost, to make the contract understandable. Doing so means that a little bit of the precision is lost and that not every permutation of every conceivable scenario is covered. This was a deliberate decision,” she says.

Monestier’s previous critiques of the industry have drawn the interest of Department of Justice antitrust lawyers, and her recent research includes a buyer’s guide concerning commissions and signing a representation agreement, a seller’s guide focusing on signing a listing agreement and a report concerning buyer representation agreements post-NAR settlement. Broadly, she has argued that many buyer agreements end up confusing and unclear to buyers, rife with legalese and poorly formatted.

“Although you wouldn’t know it from looking at these contracts, REALTORS® are under an obligation to make sure they are written in ‘clear and understandable language,’ she wrote in extensive commentary explaining her reasoning and priorities in drafting her own buyer agreement.

RISMedia asked several real estate professionals to review the agreement, offering their own critiques from the perspective of agents and brokers who deal with the practical realities of real estate every day. Many saw positives and innovations in the language, structure and focus of the agreement, while others offered their own sharp criticism.

Josh Jarboe, broker/owner of RE/MAX Empire and co-founder of Motto Mortgage A2Z, in Louisville, Kentucky, felt the contract had both pluses and minuses.

“The pros start with simplicity,” he said. “The agreement is much easier to read compared to traditional contracts. It’s more transparent and could help reduce confusion or hesitation from buyers. The flexibility on commission allows buyers to choose between a percentage or a flat fee, which could give a sense of control over costs. And there’s a cancellation clause that I appreciate as it helps build trust with clients by not locking them in too rigidly.”

Negatives, in Jarboe’s opinion, begin with potential commission confusion.

“The clause about buyers covering the difference between the seller’s contribution and agreed commission might still cause confusion, particularly for first-time buyers,” he said. “A clearer explanation or example may help. Also, there’s no clear protections for the broker. The cancellation clause could potentially leave brokers at a disadvantage if the buyer cancels too easily without proper compensation for time and resources spent.

“And while providing a list of properties post-expiration is common, the vague language around ‘more than minimal’ services might be a gray area. It could lead to disputes over what constitutes enough service to be compensated.”

Michele Harrington, CEO of First Team Real Estate in Southern California, gave Monestier’s deal big ups, while adding that her company’s agreements are personalized.

“This is better than a lot of state association contracts I have seen,” she said. “We came up with our own buyer agreement that spells out our list of services and what we do for our buyers. It has a ‘love it or list it’ clause that shows our UVPs (Unique Value Propositions) and gives us permission to ask the seller to pay commissions in the offer. It’s been very well received.”

Kendall Bonner, VP of industry relations at eXp, said that she believes brokers will be looking beyond state associations for their buyer agreements, and be more interested in how they are crafted even if they are not writing the contracts themselves.

“(W)ith the impact of the NAR settlement and current DOJ scrutiny, I suspect more and more brokers will ultimately inquire on best practices for how these documents might be written in the future. It would not surprise me to see a shift away from using forms created by local and state associations for agreements between the brokerage and the consumer,” Bonner said.

Filippo Incorvaia, founder/broker of FI Real Estate, in Miami, Florida, said that “we use a very similar simple agreement at our brokerage. In comparing ours, which is from Florida REALTORS®, last revised in July 2024 and approved by the Florida Bar, there are a few differences in this new contract which I really like.

“One section explains what happens if the seller’s contribution is less than the commission and what happens if the seller’s contribution is more than the commission. This is the best part of the agreement because it proactively answers a question that many REALTORS® have right now.

“Now all terms are negotiable, so the more clarity we can have in the agreements the better. I would consider adding a blank area to customize other terms which might be needed. The contract should reflect any prior conversations you’ve had with the clients. There is always something that is unique to each transaction which should be documented upfront. This is a great starting point but customizable is important.”

Pam Rosser Thistle, a longtime agent with Berkshire Hathaway HomeServices Fox & Roach, REALTORS® in Philadelphia, was not a fan, saying the agreement her company uses is “more comprehensive for real situations.”

“This (contract) appears to be written by someone who is not on the street selling homes—more ivory tower—and has not been through hundreds of transactions where the unexpected occurs,” she said.

Monestier says she believes industry pushback on changing buyer contracts is likely a combination of “apathy and risk aversion” within the real estate industry.

But she says that her previous work (including a collaboration with the Consumer Federation of American) and continuing research is all part of pushing for consumer protections in the real estate space, balancing the scale toward something that is legible and simple with the industry focus on trying to anticipate every possible scenario or pitfall in a buyer-agent relationship.

“They (in the industry) feel like the (current) contracts have worked ‘good enough’ until now, so why mess with them?” Monestier asks. “I also think that lawyers (hired by REALTOR® organizations) prioritize trying to cover every single contingency in an attempt to protect their clients. There is no real thought put into protecting the consumer, or making sure the consumer can actually understand what they are signing.”

“Some brokers will feel like this contract is too buyer-friendly,” she continues. “Perhaps it is. Reasonable minds can differ on where to draw the line. The sample can be a starting point for creating new forms from scratch or modifying existing ones. It also, I think, serves as proof that things do not need to be written in legalese to convey meaning.”