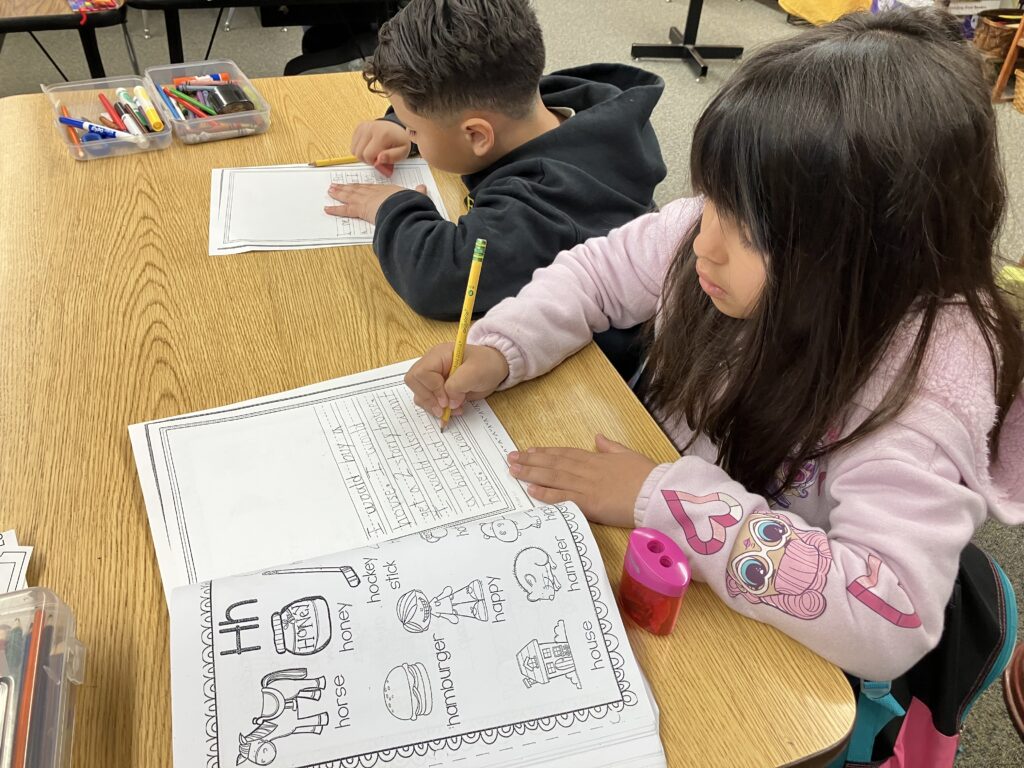

First graders at Frank Sparkes Elementary in Merced County write about how they would spend their money.

Credit: Zaidee Stavely / EdSource

Two years ago, California launched an innovative program to help children from low-income families save for their future education. Enrollment in the program, known as CalKIDS, began for all newborn babies and eligible low-income public-school students in 2022.

CalKIDS is a children’s savings account (CSA) program, a long-term wealth-building vehicle that can be used to help finance higher education. These accounts have specifically designed features (incentives and explicit structures) that encourage asset building among disadvantaged families, but they are meant to universally serve all families with children.

They provide a financial structure to collect contributions from a variety of entities such as governments, employers, philanthropic foundations, communities, private donors and others. But while CalKIDS provides each newborn with their own account, they should be thought of only as community accounts opened for individual children. CalKIDS challenges the norm that paying for college and building wealth for low-income children is solely or even mostly the responsibility of families or even the government alone.

While enrollment, account opening and initial deposits for CalKIDS are automatic, so far only 8.3% of eligible students (about 300,000) have taken the additional step of registering for the program, which is necessary for them to ultimately be able to access the funds.

But this is not a reason to despair. Registration rates alone are not the best metric for understanding or measuring the potential of this program because:

CalKIDS is likely to have a high return on investment for Californians over the long term. For example, a return-on-investment (ROI) analysis estimates that for every dollar invested by the city of St. Paul, Minnesota, in its CollegeBound program, the city will receive $9 in benefits associated with increased income, improved health, additional tax revenues and savings to the judicial and education system.

The program opens the door to multiple sources of support. The ability of CalKIDS to build wealth for children by facilitating the flow of multiple asset streams into a child’s account makes it unlike any other wealth-building tool within the state’s policy tool kit. An example of how other programs are doing this can be found in a case study on the Early Award Scholarship Program, a children’s savings account program in Indiana. They are converting traditional scholarships awarded at age 18 into early award scholarships that go into accounts long before age 18. New York City’s Kids RISE is using community scholarships, allowing groups like churches to come together and provide every child in their community with an early award scholarship. With a little foresight, CalKIDS can also be adapted to act as a financial structure for combining other efforts to support children and tackle wealth inequality, such as the “baby bonds” proposals in California.

CalKIDS can provide many other social, psychological and educational benefits. Building wealth is only one part of its potential impact on Californians. Evidence shows that children’s savings accounts reduce maternal depression, improve social-emotional development, parental educational expectations, and lead to more positive parental practices. Increasingly, evidence also shows that these programs are an effective strategy for improving children’s postsecondary outcomes. These effects can occur even when families have not contributed to their account. Moreover, the effects are often strongest among disadvantaged families.

However, it will take time to realize all the potential benefits of CalKIDS. Here are some reasons why:

- Existing norms: A seldom-discussed reason why some families may wait to register or begin to save in CalKIDS is because of the cultural norm that families don’t need to start planning for college until their children are in high school. Having become entrenched over generations, it will take time to reverse these assumptions. As more families register in CalKIDS, however, we can expect the norm of waiting to change.

- Economic conditions: According to financial needs theory, when families’ incomes increase and they have enough resources to meet basic needs, they are more likely to plan and save for college. Covid and the high inflationary period that followed have strained the ability of families to meet basic needs. This might be another reason why it might take time to see the full benefits of CalKIDS.

- Long-term investment: These are investment accounts designed to build wealth over a long period. Furthermore, the real outcomes CalKIDS is concerned with are also long-term, such as increased college enrollment rates. Given this, impacts should be examined over a longer period.

The SEED for Oklahoma Kids (SEED OK) experiment started in 2007. It provides an example of how investments in children’s savings accounts are better understood over time, and not in a single snapshot. After the Great Recession (2008-09), the initial $1,000 investment in the accounts declined to just below $700. However, they grew to about $1,900 by the end of 2019. This is similar to what has been seen in other long term investment accounts such as 401k’s. After an economic disturbance, over time they often recover.

Similarly, after Covid, which was at its peak in 2020, by 2021 when children in SEED OK were about age 14, the average treatment child had about $4,373 in their account. And families that were able to save had average balances of about $14,000. So, even if families are not able to save, significant assets accumulate in these types of accounts.

Even though it might seem like the CalKIDS program is off to a slow start, it is important to not lose sight of the fact that it is a long-term investment in kids living in California. And that it has the potential for creating a variety of important social, psychological, educational and economic impacts. These impacts can produce a substantial return on investment for the state and its citizens if given time to be fully realized.

●●●

William Elliott is a professor at the University of Michigan and founding director of the Center on Assets, Education, and Inclusion.

The opinions in this commentary are those of the author. If you would like to submit a commentary, please review our guidelines and contact us.