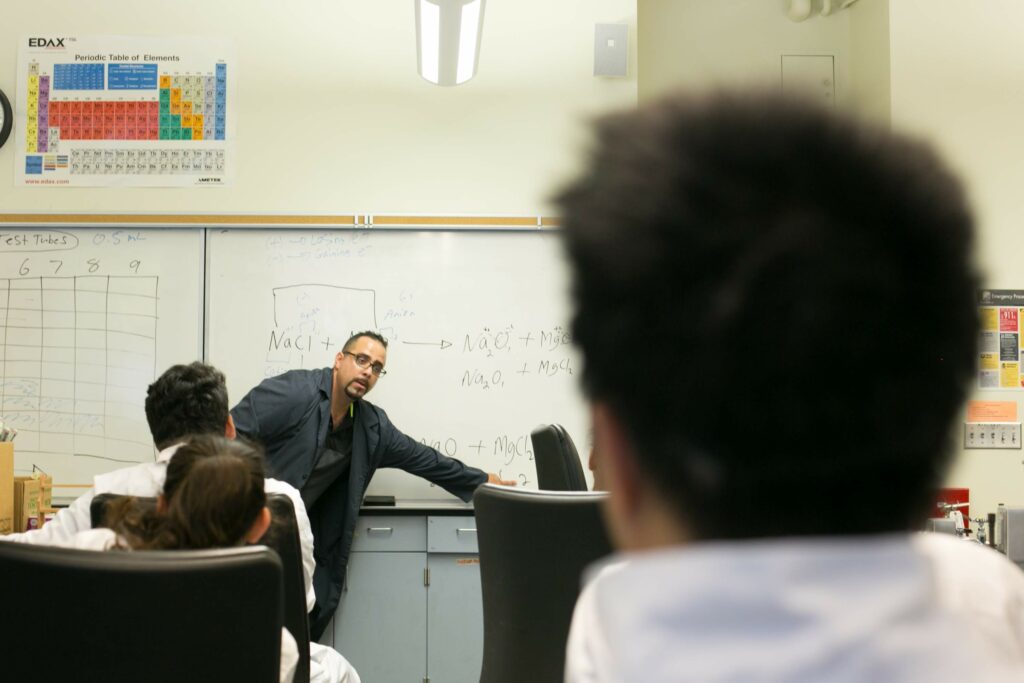

Credit: Julie Leopo / EdSource

A new report released by the College Futures Foundation finds that while a large majority of California college programs allow graduates to recoup the costs of their postsecondary education in five years or less, a handful leave recent graduates earning less than the typical Californian with only a high school education.

The report by researcher Michael Itzkowitz of the HEA Group finds programs that did not result in recent graduates earning more than people with a high school diploma were concentrated at private, for-profit colleges. The paper flags such programs as having no economic return on investment.

By contrast, all programs analyzed at the California State University and the University of California had a positive return on investment, measured as the difference between the median graduate’s earnings five years after graduation and the median earnings among Californians aged 25 to 34 with no college education. Less than 1% of programs at both university systems were expected to take more than 10 years to pay off.

Eloy Ortiz Oakley, the president and CEO of the College Futures Foundation and a former chancellor of California Community Colleges, said the report is a response to survey data highlighting increasing skepticism about the value of higher education amid its rising costs.

“Paying for a higher education is, in many ways, one of the biggest investments that a student or their family is going to make in their life, second probably only to a mortgage,” he said. “If you think about it, people get a lot more information about other investments that they’re going to make, or other indebtedness they’re getting into, than they do when they invest in an institution of higher education. So we want to make sure that there’s greater transparency and more information for the student and their families when they’re investing in higher education.”

Oakley said the report is not a judgment on whether a particular academic program should be offered as a result of its economic payoff. Rather, he said the report aims to help Californians to think of a college or university’s value less in terms of its acceptance rate and more in terms of its potential for increasing graduates’ economic mobility.

Defining ‘return on investment’

The report, “California College Programs That Pay,” analyzes data from the U.S. Department of Education’s College Scorecard to understand the earnings of roughly 260,000 people who graduated from undergraduate certificate, associate and bachelor’s degree programs in California with support from a federal loan or grant.

Looking at 2,695 programs across 324 institutions, Itzkowitz compared students’ out-of-pocket costs for a credential to the additional money they earn as a result of completing it.

To judge how much a postsecondary program costs, the study uses colleges’ self-reported data on how much students are responsible for paying after deducting grants and scholarships. That figure includes not just tuition, but also fees, books, supplies and other living costs. This net cost is used to calculate a price-to-earnings premium, a measure of how many years it will take to recoup the cost of a credential.

The study makes a couple of simplifying assumptions to calculate that premium.

The first is that students will take one year to earn a certificate, two for an associate degree and four for a bachelor’s degree. Those assumptions are not true for many students in practice. For example, only about 36% of Cal State first-year students who started in 2019 completed their degrees in four years. In cases where finishing a program over an extended period of time would be more expensive, the study could underestimate students’ actual costs.

A second assumption is that every program offered by a given institution cost the same, since cost breakdowns for given fields of study were not available.

Finally, the study universe is limited to students who graduated, not those who started a program but didn’t finish it. Previous research suggests students who start a college program but don’t receive a credential tend to earn less than graduates, Itzkowitz said, and are more likely to struggle to pay down debt.

Report highlights

Across all programs included in the study, Itzkowitz calculated that 88% prepared graduates to earn back the costs of their credential in five years or less. Median earnings five years after graduation were at least $10,000 more than those of a typical high school graduate for the vast majority of programs, too.

But 12% of programs left graduates taking five years or longer to recover out-of-pocket costs and, of those, 112 were flagged as having no economic return on investment.

The report also notes differences across education sectors. Itzkowitz found that 17% of programs offered by for-profit schools had no return on investment, compared with only 1.2% and 1.3% of majors and credentials at nonprofit and public institutions, respectively.

One way for-profit institutions differed from their nonprofit and public peers is that the for-profit institutions offered the most undergraduate certificates in the state — and a larger share of those programs resulted in no economic payoff. Two fields, cosmetology and somatic bodywork, stood out as having the most programs with no measured return on investment.

Still, many programs showed returns even at a one-year time horizon. The report calculated that almost half of programs at public institutions allowed graduates to recoup the costs of their credential within a year. Among private, nonprofit institutions, 7% of programs positioned graduates to earn back their costs within that period. Thirteen percent of for-profit institutions met the same criteria.

Oakley said that he hopes the report inspires more research into whether higher-earning programs are attracting students of color, where high-return programs are located regionally and how to replicate programs giving the best economic payoff.

“There are a lot of programs within our public institutions that provide a good return on investment,” he said. “What surprises me is that when we ask those institutions why, they don’t necessarily know why.”

Other approaches to measuring the value of college

While the College Futures Foundation report focuses on graduates’ earnings in the five years after they graduate, other recent research has sought to project college-goers’ earnings over a longer time horizon.

For example, a 2019 report from Georgetown University’s Center on Education and the Workforce ranked 4,500 colleges by calculating their projected returns 40 years after enrollment. That analysis estimates the net present value of a student’s potential future earnings — that is, it balances the costs of paying for a college education today against the potential for higher earnings over time.

The Foundation for Research on Equal Opportunity in May released a study framing return on investment in terms of how much college increases a student’s lifetime earnings after subtracting the costs of college. Rather than compare college-goers to the median high school graduate, that study estimates what college-goers would have earned had they not pursued higher education. It also takes into account colleges’ actual completion rates, a step that acknowledges the risk to students that start a program but don’t finish it.

EdSource receives funding from several foundations, including the College Futures Foundation. EdSource maintains sole editorial control over the content of its coverage.