Are real estate commissions falling? Every REALTOR® has been asking that since NAR’s rule changes mandating buyer agent agreements went into effect earlier this year.

RISMedia’s 2024 Contract & Commission Study—surveying 1,300 agents and brokers—found that yes, commissions have fallen noticeably since NAR’s settlement. By how much varies, though, and of the four major U.S. census regions, the Northeast (New England and the upper mid-Atlantic) showed the least decline.

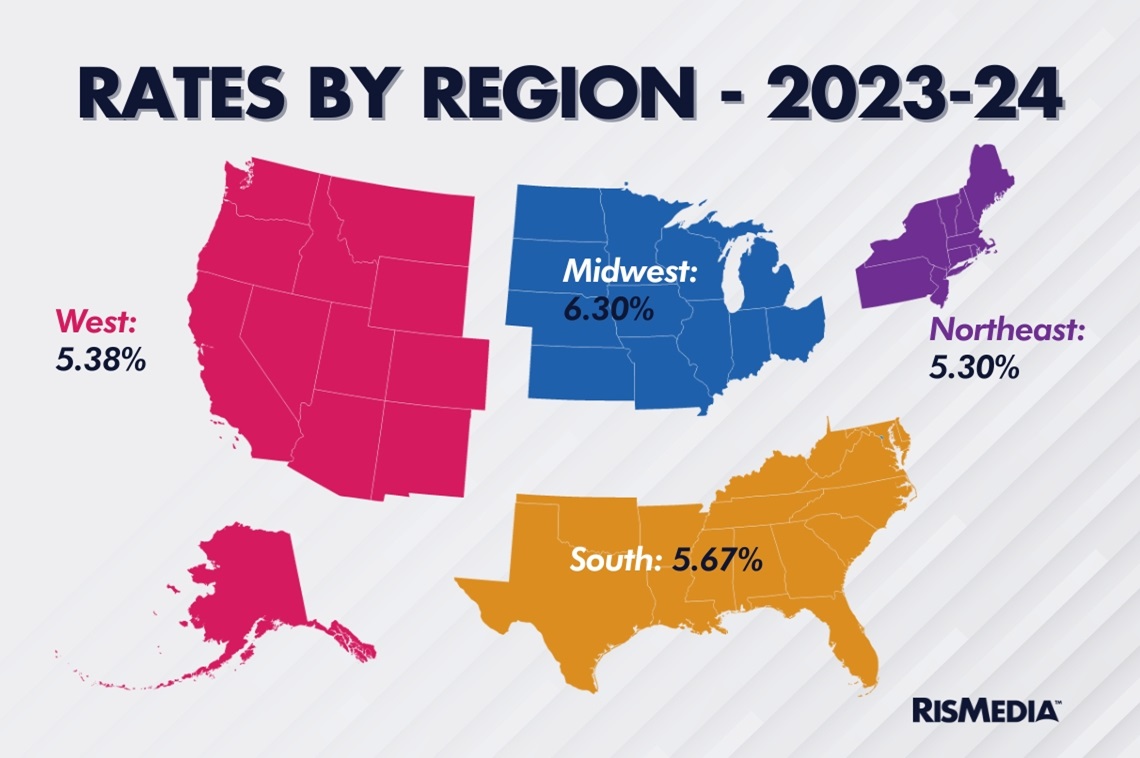

From 2023 to 2024, but before the settlement, the Northeast had the lowest average commission rate (see below):

Northeast states currently have a high cost of living, particularly the region’s largest metro areas such as New York City and Boston.

According to NAR’s latest report on interstate migration trends, Northeastern states are the least popular destination for homeowners seeking to move to a new state. This indicates that not only is the region not attracting new residents, but homeowners who already live in, say, Massachusetts, are moving to Florida or Texas (note high commissions in the South) rather than another Northeastern state like New Hampshire or Vermont.

After the settlement, the average commission for a Northeast agent still came down by 0.5%, but this is the lowest nationwide drop, and was even less pronounced on the buy side.

Is the relatively smaller drop in the Northeast tied to NAR changes? While that is the obvious new variable in the equation, RISMedia spoke to local brokers who were not so sure.

Anthony Lamacchia, broker/owner and CEO of Lamacchia Companies (also a recent guest on RISMedia’s RealEdge podcast), said this lower drop boils down to the conditions of the Northeast market: “The higher the average sales price, the less there is pushback on commissions.”

However, Lamacchia is also skeptical of the idea that the NAR settlement and resulting rule changes will be an albatross, or indeed already is.

“This initial decrease in fees is likely just a byproduct of the changes being so recent. Over the long haul, I do not see fees being negatively affected, especially as we get back into a higher inventory market,” he said. “These fees are more impacted by inventory levels of homes for sale and the overall market than they are by ridiculous, frivolous lawsuits.”

Lamacchia’s point about commission pushback (or lack thereof) in high-priced markets can help explain the experience of Frances Katzen, founder of Douglas Elliman’s New York-based Katzen Team. Katzen tells RISMedia that in New York City, sellers have largely (and electively) chosen to stick with the old “seller pays the buyer broker” compensation model.

“I think sellers took one look at what was going on and knew that (the settlement changes were) going to be such a negative impact on holding values, not only for their property, but for the building. But it just made common sense to maintain the structure of the seller pay commission,” she explained. “There was a perfect example: we had a broker who had a client for many, many years who decided to play that game of ‘I’m not going to pay the commission.’ And then we had a broker next door who took a listing literally next door and sold it. So I happen to think that says it all in the end: smart people understand where the value is, and that’s not a value play.”

An important detail about the settlement is the seller-pays-commission model was not banned, only advertisements of it in MLS listings. That is, sellers still have the option to compensate buyers and, per Katzen, NYC sellers are doing just that:

“I think it’s a testament to the fact that at the end of the day, the sellers recognize that while (this commission model is) not a requirement or an obligation, it’s an industry standard practice that has helped yield and protect not only the seller’s price, but buildings’ value. And when you try to incentivize and put more on a procuring party that has less to spend based on rate impact, it sets a very bad precedent for real estate in general. And I think at the end of the day, it needs to be acknowledged. That is why it has been retained, because it’s not smart business.”

For the full RISMedia Contract & Commission Study, click here.